Case Study

Adding a Feature

ADDING A FINANCIAL RECORD FEATURE TO THE LAST PASS APP

Design and develop an intuitive interface to facilitate categorization and seamless search functionalities of receipts linked to passwords stored on the Last Pass app.

SCOPE

PROBLEM

GOALS

Role Role UX Researcher, UX Designer, UI Designer, Branding

Tools Figma, Illustrator, Photoshop

Timeline 6 Weeks

Many Americans feel very stressed during tax season. Whether employed by a company or working for themselves, everyone must calculate work expenses to reduce taxes. Freelancers, especially, are under pressure to track every deduction by checking receipts and bank statements each year. While paying with mobile apps is convenient, monitoring expenses can be difficult.

Enhance the functionality of the LastPass app by adding a receipts feature providing users with a convenient and centralized location to manage their receipts.

Users will be able to track receipts, simplify expense reporting, and improve financial management.

Enable users to easily search and retrieve receipts based on various parameters such as date, amount, or vendor.

Integrate with existing features of the LastPass app, such as password autofill and secure notes, to provide a seamless user experience.

Positive user feedback indicating the usefulness and convenience of the receipts feature.

Increased engagement and retention.

KEY PHASES

DISCOVER

There are 56.7 million freelancers in the US.

Freelancers comprise 35% of the US workforce.

Freelancers contribute $1.3 trillion to the US economy on a yearly basis.

The majority of the US workforce will freelance by 2027.

Freelance workforce growth consistently outpaces overall US workforce growth by 3 times.

53% say they will not go back to a traditional job

82% of full-time freelancers say they’re happier working on their own.

4.1 million freelancers identify as digital nomads.

63% of freelancers feel anxious about all they have to accomplish.

RESEARCH

In researching some popular accounting app services I noted some general pros and cons to understand the needs of the user.

pros

easy to use

free version

seamless integration with other features

cons

confusing interfaces

syncing problems

unstable software

USER INTERVIEWS

Interviews were conducted to understand stress and pain points of keeping track of ones expenses throughout the year.

Occupations among the people interviewed were:

Photographer / Ceramicist

Makeup Artist / Opera Singer

Travel Writer / Pilates Teacher

Recent Art School Graduate

Prop Stylist / Interior Designer

Interview Question Samples:

How do you currently keep track of your tax write-offs throughout the year?

What specific tools or software do you use to organize and categorize your expenses for tax purposes?

What are your best practices for organizing and maintaining records of receipts, invoices, and other

supporting documentation for tax write-offs?

Can you provide an example of a common tax write-off for freelancers and how you would document it?

How do you ensure that you capture all eligible expenses for tax write-offs?

Have you ever faced challenges or difficulties in tracking your tax write-offs? If so, how did you handle them?

AFFINITY MAP

Findings from interviews were compiled into an affinity map.

Noteable Findings

Generally, users shared common disdain for having to label, categorize, and file each and every receipt / transaction. With various payment options available today like credit cards, debit cards, cash, and different mobile apps, freelancers and small businesses feel compelled to review transactions thoroughly.

A few samples for receipt of payment:

paper receipts (in person retail)

text receipts (coffee shop / client lunches)

login account receipts (cell phone / Internet / Web Hosting)

combing through credit card statements to see if anything was overlooked

the many ways to pay…

…link the receipts to password vaults for easy access

USER PERSONA

Our persona “self employed Sage” helps ideate and conceive ideas that will be most beneficial to most self-employed people.

The common and ultimate goal is not missing out on any potential tax deduction.

As a 35 year old city dwelling designer, Sage is a freelancer with an erratic schedule. New clients can pop up at any moment. Keeping track of current jobs while networking for new business, is always an obstacle it can be hard to track specific expenses and stay up-to-date.

DEFINE

TASK FLOWS

The task of retrieving receipt data will be added to each password accounts’ vault.

Flow 1

Original / Current Login and add a password to a user’s last pass vault

Flow 2

Original / Current Login and find a password in a user’s established last pass vault

Flow 3

New Login and find receipts in a user’s established last pass vault

DEVELOP

LOFI WIREFRAMES

By sourcing Last Pass UI from the web I was able to recreate screens to create a new prototype with the new intended flow

Email purchase history

Scan and Email a Receipt

Upload a receipt from your device to vendor category

DELIVER

INTERACTIVE PROTOTYPES

FLOW 1

Email purchase history (as well as print or airdrop)

login >

locate vendor >

order history >

view totals >

email payment history >

FLOW 2

Scan and upload receipt to a vault

login >

locate vendor >

scan receipt >

choose calendar timeframe >

scan with phone camera >

save

FLOW 3

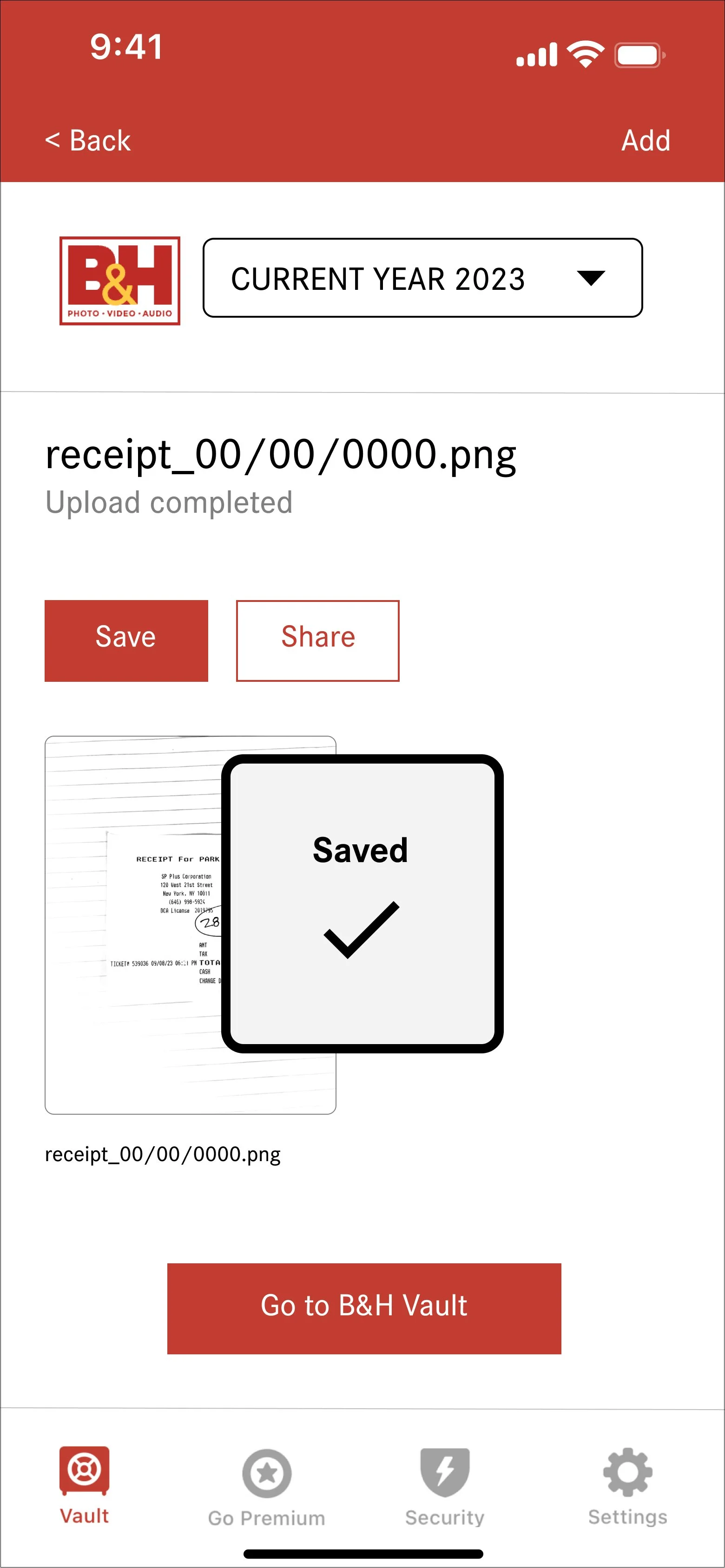

Upload a receipt from your device to vendor category

login >

locate vendor >

upload receipt from device >

choose from camera roll >

save

USER TESTING INSIGHTS

User testing yielded successful results. The added features were simple / minor additions resulting in major improvements when it comes to organizing finances.

Since Last Pass is foremost an organization app the added features were easy to implement.

Users were able to navigate the site and perform tasks with ease.

ITERATIONS

As I was prepping for this current tax season I noticed a feature on the LYFT app that allows you to choose “a la carte” transactions and export them into an exportable report

IN CONCLUSION

This project seemed simple enough to begin with, but learning of the many ways people track expenses, spend for various types of businesses, and organize for tax time led me to realize that there are so many ways to prep for accountants at tax time.

By the end of this project I’m realizing that features like the ones I implemented could maybe take the place of subscription tracking apps like Rocket Money.

A design constraint of the project was working with the current UI of the Last Pass app. It isn’t the most exciting and a bit sterile. If there was more time I would try to make the visual features more engaging.

As it is tax time while I’m finishing the project, another idea I would be interested in testing is seeing spending totals across all vendors in ones Last Pass vault. Most freelancers need to spend a certain amount of money throughout the year on business expenses in order to maximize their tax deductions. If you could see a spending summary throughout the year it would be great to be able to be financially prepared and save at tax time.

MOBIL

Case Study

Adding a Feature

ADDING A FINANCIAL RECORD FEATURE TO THE LAST PASS APP

In my 20 years of being self-employed calculating detailed expenses during tax season, besides common deductions like home office and credit card interest, has been complex and time-consuming.

SCOPE

Design and develop an intuitive interface to facilitate categorization and seamless search functionalities of receipts linked to passwords stored on the Last Pass app.

Many Americans feel very stressed during tax season. Whether employed by a company or working for themselves, everyone must calculate work expenses to reduce taxes. Freelancers, especially, are under pressure to track every deduction by checking receipts and bank statements each year. While paying with mobile apps is convenient, monitoring expenses can be difficult.

PROBLEM

Enhance the functionality of the LastPass app by adding a receipts feature providing users with a convenient and centralized location to manage their receipts.

Users will be able to track receipts, simplify expense reporting, and improve financial management.

Enable users to easily search and retrieve receipts based on various parameters such as date, amount, or vendor.

Integrate with existing features of the LastPass app, such as password autofill and secure notes, to provide a seamless user experience.

Positive user feedback indicating the usefulness and convenience of the receipts feature.

Increased engagement and retention.

GOALS

Role UX Researcher, UX Designer, UI Designer, Branding

Tools Figma, Illustrator, Photoshop

Timeline 6 Weeks

DISCOVER

Research

Interviews

Affinity Map

User Persona

DEFINE

Task Flow

User Flow

Mapping

DEVELOP

Sketches

Wireframes

UI Screens

DELIVER

Prototype Testing

Iterations

Final Prototype

Conclusion

KEY PHASES

DISCOVER

There are 56.7 million freelancers in the US.

Freelancers comprise 35% of the US workforce.

Freelancers contribute $1.3 trillion to the US economy on a yearly basis.

The majority of the US workforce will freelance by 2027.

Freelance workforce growth consistently outpaces overall US workforce growth by 3 times.

53% say they will not go back to a traditional job

82% of full-time freelancers say they’re happier working on their own.

4.1 million freelancers identify as digital nomads.

63% of freelancers feel anxious about all they have to accomplish.

RESEARCH

In researching some popular accounting app services I noted some general pros and cons to understand the needs of the user.

pros

easy to use

free version

seamless integration with other features

cons

confusing interfaces

syncing problems

unstable software

USER INTERVIEWS

Interviews were conducted to understand stress and pain points of keeping track of ones expenses throughout the year.

Occupations among the people interviewed were:

Photographer / Ceramicist

Makeup Artist / Opera Singer

Travel Writer / Pilates Teacher

Recent Art School Graduate

Prop Stylist / Interior Designer

Interview Question Samples:

How do you currently keep track of your tax write-offs throughout the year?

What specific tools or software do you use to organize and categorize your expenses for tax purposes?

What are your best practices for organizing and maintaining records of receipts, invoices, and other

supporting documentation for tax write-offs?

Can you provide an example of a common tax write-off for freelancers and how you would document it?

How do you ensure that you capture all eligible expenses for tax write-offs?

Have you ever faced challenges or difficulties in tracking your tax write-offs? If so, how did you handle them?

AFFINITY MAP

Findings from interviews were compiled into an affinity map.

Noteable Findings

Generally, users shared common disdain for having to label, categorize, and file each and every receipt / transaction. With various payment options available today like credit cards, debit cards, cash, and different mobile apps, freelancers and small businesses feel compelled to review transactions thoroughly.

A few samples for receipt of payment:

paper receipts (in person retail)

text receipts (coffee shop / client lunches)

login account receipts (cell phone / Internet / Web Hosting)

combing through credit card statements to see if anything was overlooked

the many ways to pay…

…link the receipts to password vaults for easy access

USER PERSONA

Our persona “self employed Sage” helps ideate and conceive ideas that will be most beneficial to most self-employed people.

The common and ultimate goal is not missing out on any potential tax deduction.

As a 35 year old city dwelling designer, Sage is a freelancer with an erratic schedule. New clients can pop up at any moment. Keeping track of current jobs while networking for new business, is always an obstacle it can be hard to track specific expenses and stay up-to-date.

TASK FLOWS

DEFINE

FLOW 1

Original / Current Login and add a password to a user’s last pass vault

FLOW 2

Original / Current Login and find a password in a user’s established last pass vault

FLOW 3

New Login and find receipts in a user’s established last pass vault

The task of retrieving receipt data will be added to each password accounts’ vault.

DEVELOP

By sourcing Last Pass UI from the web I was able to recreate screens to create a new prototype with the new intended flow

LOFI WIREFRAMES

Email purchase history

Scan and Email a Receipt

Upload a receipt from your device to vendor category

DELIVER

INTERACTIVE PROTOTYPES

FLOW 1

Email purchase history (as well as print or airdrop)

login >

locate vendor >

order history >

view totals >

email payment history >

(best viewed on figma app)

Scan and upload a receipt to a vault

FLOW 2

login >

locate vendor >

scan receipt >

choose calendar timeframe >

scan with phone camera >

save

(best viewed on figma app)

FLOW 3

Upload a receipt from your device to vendor category

login >

locate vendor >

upload receipt from device >

choose from camera roll >

save

(best viewed on figma app)

User testing yielded successful results. The added features were simple / minor additions resulting in major improvements when it comes to organizing finances.

USER TESTING INSIGHTS

Since Last Pass is foremost an organization app the added features were easy to implement.

Users were able to navigate the site and perform tasks with ease.

As I was prepping for this current tax season I noticed a feature on the LYFT app that allows you to choose “a la carte” transactions and export them into an exportable report

ITERATIONS

This project seemed simple enough to begin with, but learning of the many ways people track expenses, spend for various types of businesses, and organize for tax time led me to realize that there are so many ways to prep for accountants at tax time.

By the end of this project I’m realizing that features like the ones I implemented could maybe take the place of subscription tracking apps like Rocket Money.

A design constraint of the project was working with the current UI of the Last Pass app. It isn’t the most exciting and a bit sterile. If there was more time I would try to make the visual features more engaging.

As it is tax time while I’m finishing the project, another idea I would be interested in testing is seeing spending totals across all vendors in ones Last Pass vault. Most freelancers need to spend a certain amount of money throughout the year on business expenses in order to maximize their tax deductions. If you could see a spending summary throughout the year it would be great to be able to be financially prepared and save at tax time.

IN CONCLUSION